south carolina inheritance tax 2019

This chapter may be cited as the South Carolina Estate Tax Act. You should also keep in mind that some of your property wont technically be a part of your estate.

A Guide To South Carolina Inheritance Laws

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

. Maryland imposes the lowest top rate at 10 percent. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Ad Estate Trust Tax Services.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Has the highest exemption level at 568 million. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

However the federal government still collects these taxes and you must pay them if you are liable. As an example consider the family from Pennsylvania who. If an estate is worth 15 million 36 million is taxed at 40 percent.

2019 the New York estate tax exemption amount will be the same as the federal estate tax applicable exclusion amount prior to the 2017 Tax Act which is. South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

7 00 8 TAX on Active Trade or Business Income attach I-335. 1 Decedent means a deceased person. Our Estate Tax Calculator is an educational tool that allows you to enter financial variables related to assist you in understanding how Federal Estate Taxes and South Carolina Estate Taxes are calculated.

Learn How EY Can Help. So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. What are the estate taxes in South Carolina.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that might come from another state or a. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

All six states exempt spouses and some fully or partially exempt immediate relatives. South Carolina does not implement estate taxes so your South Carolina estate. This is your TOTAL SOUTH CAROLINA TAX10 00 30752190 Page 2 of 3 Your SSN _____ 2019.

Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. 2 Federal credit means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

For instance if Mom and Dad die with 3000000 in their estate but they have three children who each inherit 13 of that estate 1000000 then each of the children may pay an inheritance tax on the 1000000 received if they live in a state which has an inheritance tax. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. Even though South Carolina does not collect an inheritance tax however you could end up paying inheritance tax to another state. South Carolina has no estate tax for decedents dying on or after January 1 2005.

See where your state shows up on the board. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. This is because the six states that assess an inheritance tax tax the recipient of an inheritance no matter what state he or she is living in.

To inherit under South Carolinas intestate succession statutes a person must outlive you by 120 hours. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. South Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. 9 00 10Add line 6 through line 9 and enter the total here. Tax was permanently repealed in 2014 with repeal of all of.

You pay inheritance tax as part of your income taxes in the form of inheritance-based. And to show you how changing variables may change the result. Every state has its own unique set of laws that go into inheriting estates and south carolina is no exception.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. 8 00 9 TAX on excess withdrawals from Catastrophe Savings Accounts. Neither South Carolina nor North Carolina have an inheritance tax but people who live here are sometimes still forced to pay inheritance taxes.

Unlike some other states there are no inheritance or estate taxes in South Carolina. Massachusetts has the lowest exemption level at 1 million and DC. 7 TAX on Lump Sum Distribution attach SC4972.

An inheritance tax is a tax based on what a beneficiary actually receives from an estate. Inheritances that fall below these exemption amounts arent subject to the tax.

South Carolina Sales Tax On Cars Everything You Need To Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

A Guide To South Carolina Inheritance Laws

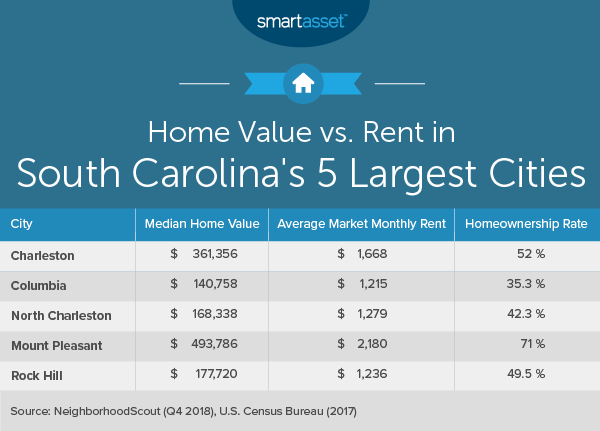

Cost Of Living In South Carolina Smartasset

Pin By Roxanne Hoover On Got To Go Florida Tax Rate Income Tax Moreno

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Thinking About Moving These States Have The Lowest Property Taxes

Real Estate Property Tax Data Charleston County Economic Development

A Guide To South Carolina Inheritance Laws

The Pros And Cons Of Retiring In South Carolina

What You May Have Missed The Pros And Cons Of Living In South Carolina

States With No Estate Tax Or Inheritance Tax Plan Where You Die